Are millennials better or worse off than Gen-Xers at the same age?

Millennials are now the largest generation of people in Canada. They’re the most educated and diverse generation, but they face unique challenges…

- Millennials had higher after-tax household incomes than young Gen-Xers. Median after-tax household income between 25 and 34 years old

- Millennials in 2016 $66,500

- Young Gen-Xers in 1999 $51,000

- Millennials had higher assets and net worth than young Gen-Xers, but they also carried more debt.

- Homeownership, living in Toronto or Vancouver, and having a higher education were three factors associated with higher net worth.

- Millennials are relatively more indebted… Debt-to-after-tax income ratio

- 216% Millennials in 2016

- 125% Young Gen-Xers in 1999

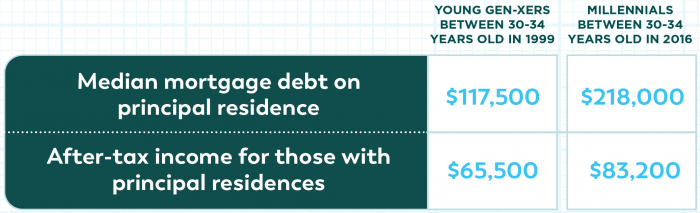

- Though millennials are entering the housing market at similar rates as previous younger generations, they are taking on larger mortgages.

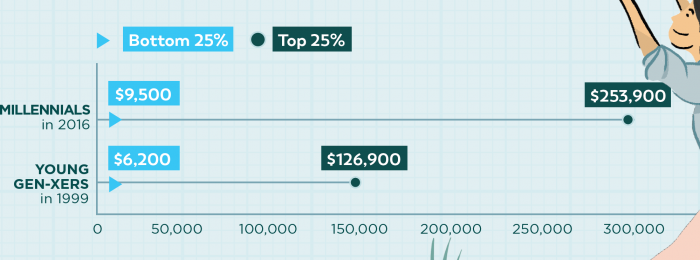

- Though their median net worth is higher, there are greater differences in economic well-being among millennials. Millennials in the top 10% held 55% of all total net worth accumulated by their generation.

Notes: Unless otherwise notes, millennials represent those between 25 and 34 years old in 2016, and young Gen X-ers indicate those between 25 and 34 years old in 1999.

Results are presented in 2016 current dollars and adjusted for inflation to allow a comparison over time. Statistics provided refer to the age and generation of the major income earner in the household or family.

ASSETS VS. LIABILITIES

Assets are what you own:

- Cash

- The value of your residence

- Artwork

- Automobile

- Checking account

- Collectibles

- Electronics

- Jewelry

- Investment accounts

- Retirement account

- Savings account

Liabilities are what you owe:

- Unsecured debts

- Car loan

- Mortgage

- Student loans

- Accounts payable

- Income taxes payable

- Bills payable

- Bank account overdrafts

- Accrued expenses

- Short-term loans

Article Published by DLC Marketing Team