Increasing mortgage rates weighed heavily on housing in September

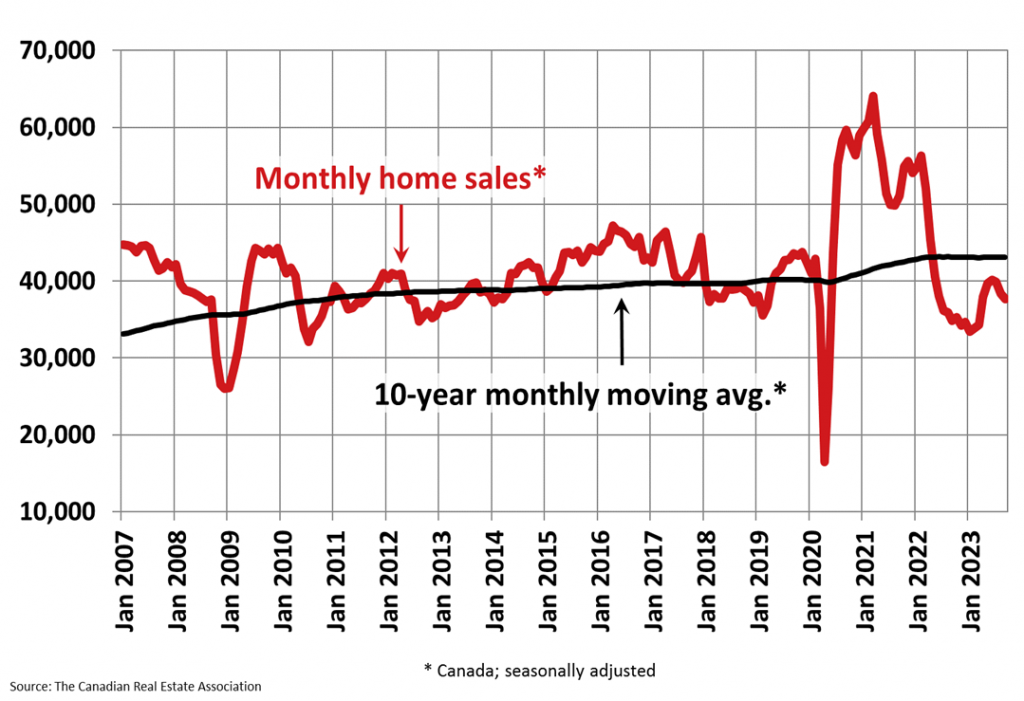

Mortgage rates continued to rise in September after BoC tightening and one of the largest bond selloffs in history. Yields have retraced some of their rise more recently, but demand for new and existing homes has slowed. According to data released by the Canadian Real Estate Association, national home sales declined 1.9% m/m in September, its third consecutive monthly decline. At least September’s drop was about half as large as in August, dominated by weakness in the Greater Vancouver and the Greater Toronto Area. Sales gains were posted in Edmonton, Montreal and the Kitchener-Waterloo region.

The actual (not seasonally adjusted) number of transactions in September 2023 came in 1.9% above September 2022, but that was far less than the growth in the Canadian population over that period.

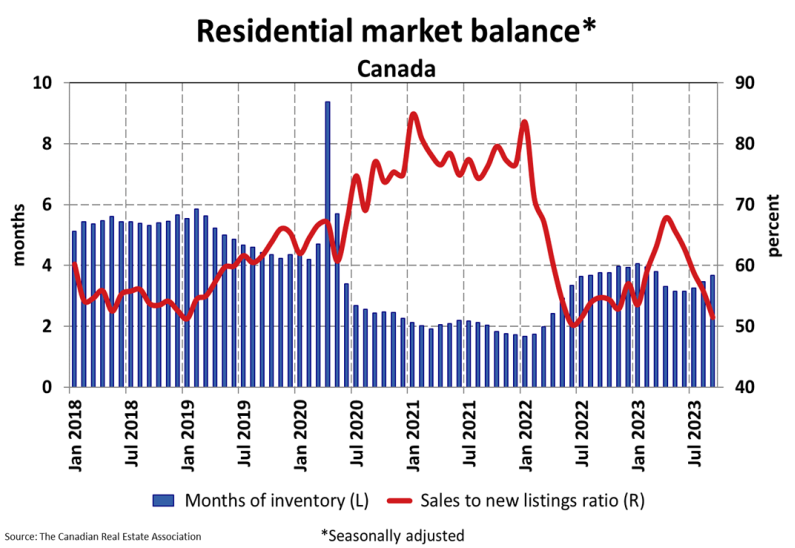

The CREA updated its forecast for home sales activity and average home prices for the remainder of this year and next. They commented that the national sales-to-new listings ratio has fallen from nearly 70% to 50% in the past five months, slowing the price rally in April and May. The CREA has cut its forecast for sales and prices, reflecting the marked slowdown in Ontario and BC. The expected rebound in activity next year has also been muted as interest rates remain higher for longer than initially expected.

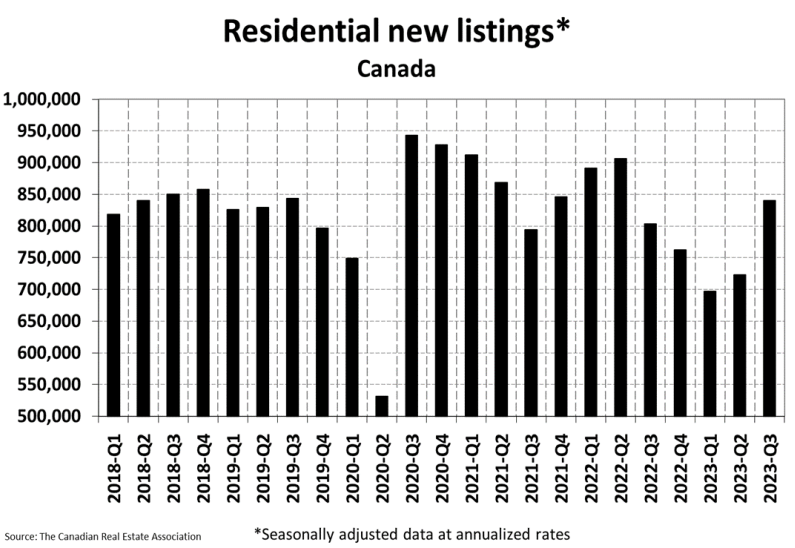

New Listings

The big news in this report was the surge in new listings as sellers finally come off the sidelines. The number of newly listed homes climbed 6.3% m/m in September, posting a 35% cumulative increase from a twenty-year low since March. New listings are trending near average levels now.

With sales continuing to trend lower and new listings posting another sizeable gain in September, the national sales-to-new listings ratio eased to 51.4% compared to 55.7% in August and a recent peak of 67.8% in April. It was the first time that this measure has fallen below its long-term average of 55.2% since January. There were 3.7 months of inventory nationally at the end of September 2023, up from 3.5 months in August and its recent low of 3.1 months in June. That said, it remains below levels recorded through the second half of 2022 and well below its long-term average of about five months.

Home Prices

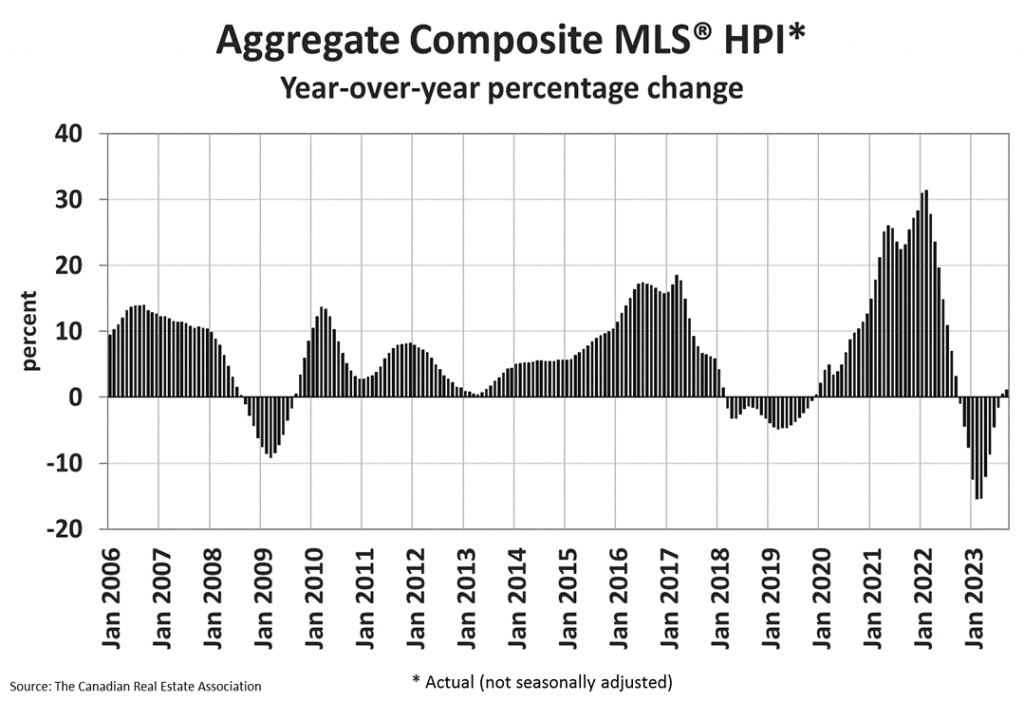

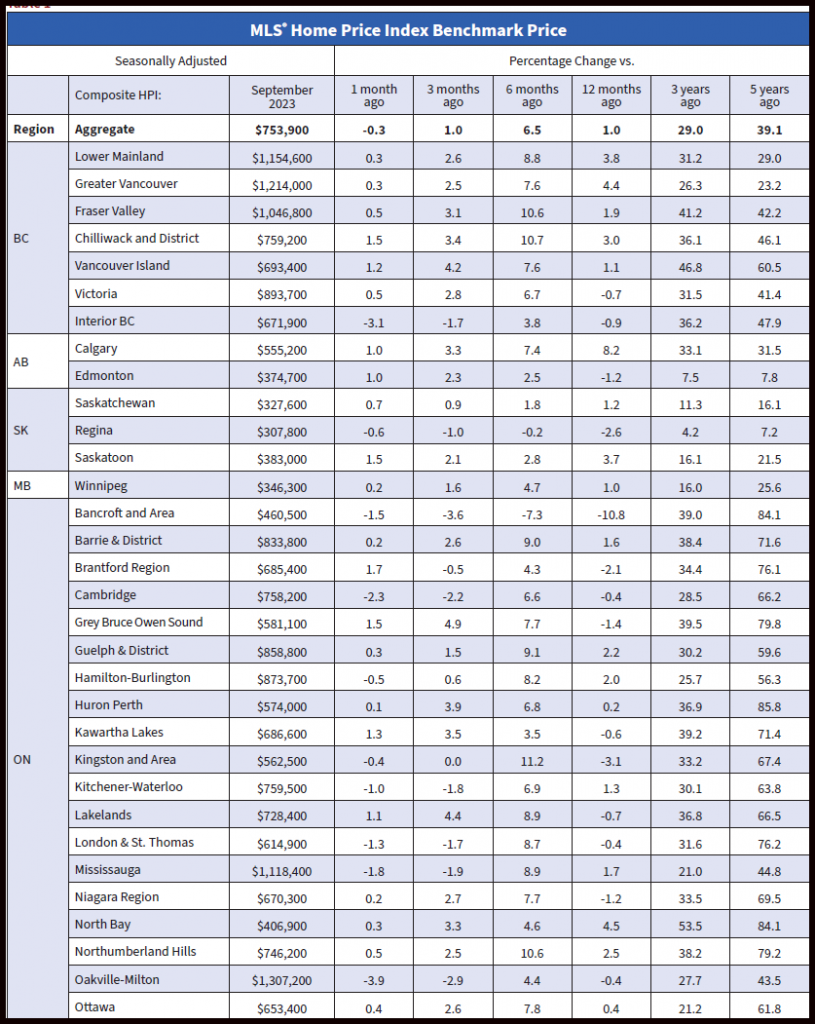

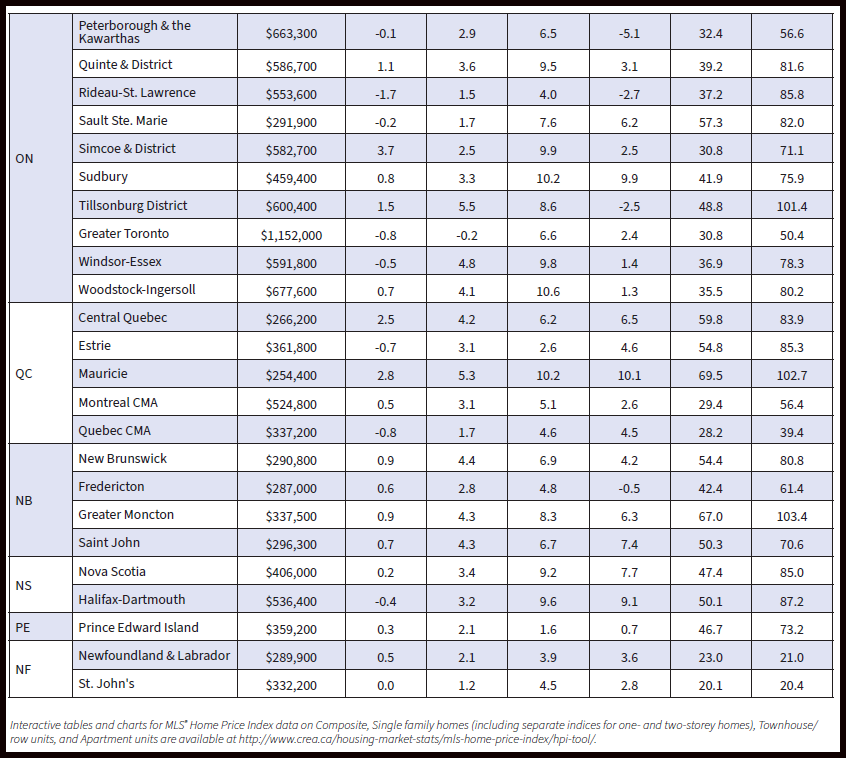

The Aggregate Composite MLS® Home Price Index (HPI) edged down 0.3% m/m in September 2023— the first decline since March.

That said, the slight dip in prices at the national level in September was entirely the result of trends in Ontario. Prices are still rising across other provinces, albeit more slowly than they were.

Incoming data over the next few months will determine whether Ontario is an outlier or just the first province to show the softening price trends expected to play out in at least some other parts of the country, given where interest rates are. The Aggregate Composite MLS® HPI was up 1.1% y/y. While prices have generally been levelling off in recent months and even dipped nationally and in Ontario in September, year-over-year comparisons will likely continue to rise slightly in the months ahead because of the base effect of declining prices in the second half of last year.

Bottom Line

The Bank of Canada policymakers are set to meet on October 25, weighing the strong wage growth and employment gains against next Tuesday’s September inflation report. The US inflation data, released this week, was only a touch higher than expected. The Canadian information will unlikely disrupt the central bank’s pause in rate hikes.

The unexpected Israeli war will disrupt the global economy again, which could cause supply chain concerns if it lasts long enough. Oil prices and technology (semiconductor chips and other tech-related products) could be impacted. With so much uncertainty and a marked third-quarter economic data slowdown, the BoC will likely remain on the sidelines.

Please Note: The source of this article is from SherryCooper.com/category/articles/